does wyoming charge sales tax

In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. This perk is commonly known as the ITC short for Investment Tax Credit.

Car Tax By State Usa Manual Car Sales Tax Calculator

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Wyoming.

. The state sales tax rate in Wyoming is 4. Charge the tax rate of the buyers address as thats the destination of your product or service. Are services subject to sales tax in Wyoming.

In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and. Alaska Delaware Montana New Hampshire and Oregon. This is the same whether you live in Wyoming or not.

This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. This page describes the taxability of food and meals in Wyoming including catering and grocery food. The states with the lowest combined state and local sales tax rates are Hawaii Wyoming Wisconsin and Maine.

Wyoming eliminated the sales tax on groceries in 2006 and made the exception permanent in 2007. Sales tax is a large revenue driver for 45 states and the District of Columbia. But if the vendor presents it as 195 for shampoo delivered then the full 195 is subject to Wyoming sales tax What does this mean.

Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. Wyoming is a destination-based sales tax state. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

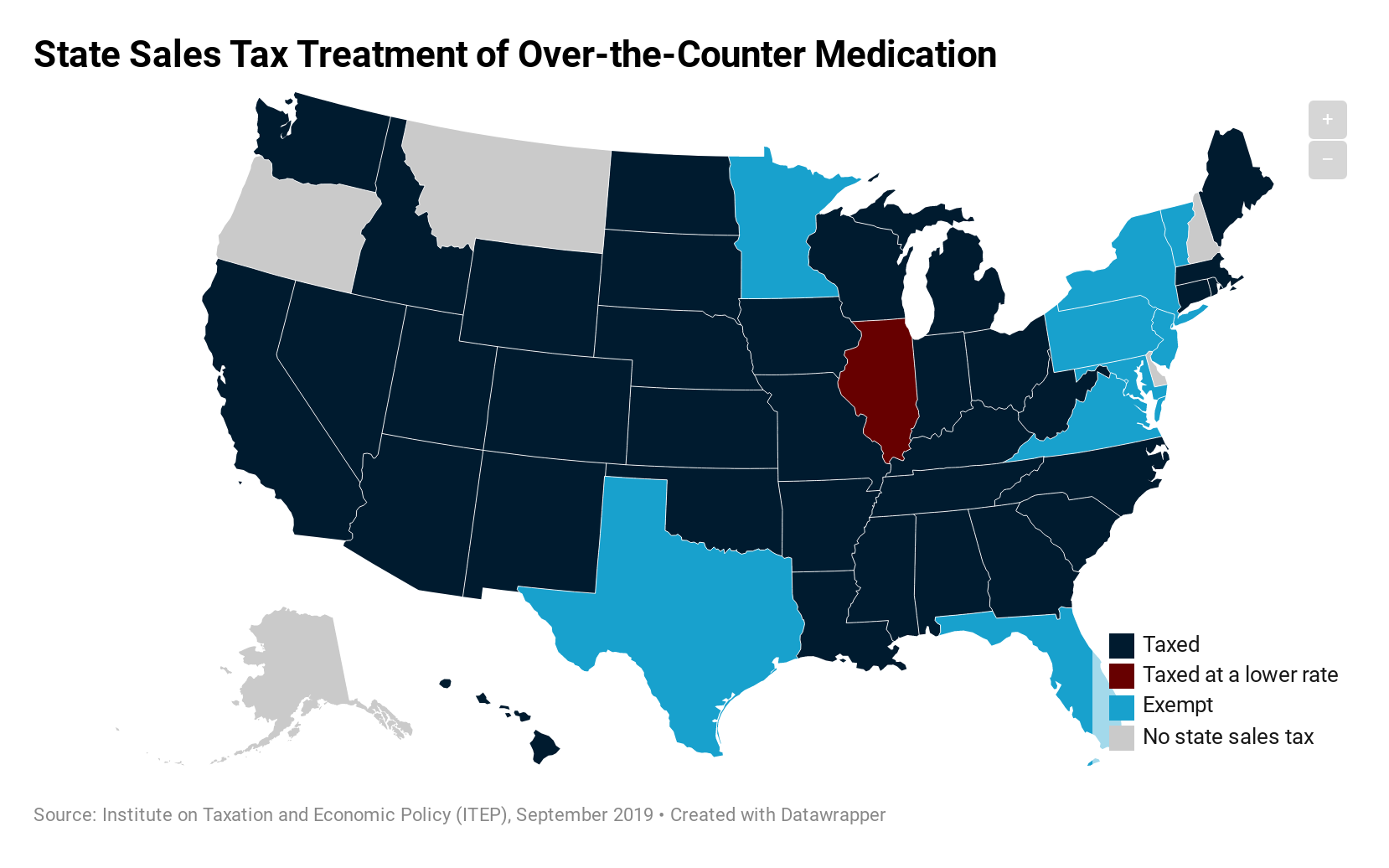

Groceries and prescription drugs are exempt from the Wyoming sales tax. Wyoming has 167 special sales tax jurisdictions with local sales taxes in. Wyomings tax on a room can and has reached the 10 mark in some communitiesResearch shows total room taxes above 10 discourage extra traveler spendingLodging businesses in Wyoming are assessed the county sales taxes PLUS any.

You can find more information above. An example of taxed services would be one which sells repairs alters or improves tangible physical property. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs alterations or improvements to tangible personal property in the scope of those services.

Whether you must charge your customers out-of-state sales taxes comes down to whether youre operating in an origin-based sales tax state or a destination-based sales tax state. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. However imposing a tax tends to be less politically palatable than repealing one.

Twenty-three states and DC. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

Wyoming has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. Now that the state has a severe deficit lawmakers could revisit this proposal. This page describes the taxability of services in Wyoming including janitorial services and transportation services.

Wyoming does have a sales tax which may vary among cities and counties. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. Is the shipping and handling charge taxable in Wyoming.

There are additional levels of sales tax at local jurisdictions too. Treat either candy or soda differently than groceries. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. State wide sales tax is 4.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. Those were better times when the state was feeling flush.

See the publications section for more information. The state-wide sales tax in Wyoming is 4. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. To learn more see a full list of taxable and tax-exempt items in Wyoming. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. So if you live in Wyoming collecting sales tax is not very easy. The state sales and use tax rate is 575 percent.

If the vendor presents the invoice to the consumer as 170 for the shampoo and 025 for a separately stated delivery fee then only the 170 is subject to Wyoming sales tax. Of the states that charge sales tax Colorado has the lowest at a rate of 29 percent followed by Alabama Georgia Hawaii New York and Wyoming which each charge 4 percent. Several other states such as Delaware South Dakota and Washington tax some services.

Sales Tax Exemptions in Wyoming. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. To learn more see a full list of taxable and tax-exempt items in Wyoming.

You must collect sales tax at the tax rate where the item is being delivered. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates. If you install your photovoltaic system in 2020 the federal tax credit is.

This page discusses various sales tax exemptions in Wyoming. There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon. It is also the same if you will use Amazon FBA there.

Does Wyoming charge sales tax on vehicles. The process of determining which tax rates apply to individual purchases is referred to as sales tax sourcing and it can be somewhat complicated to figure out. According to the Tax Foundation the average taxpayer will pay just over 1000 per year in sales taxIn the 2020.

Why Do Some States Have A Sales Tax But Others Don T Debt Com

No Sales Tax In Good Old Montana Montana Bozeman Montana Montana Skies

Woocommerce Sales Tax In The Us How To Automate Calculations

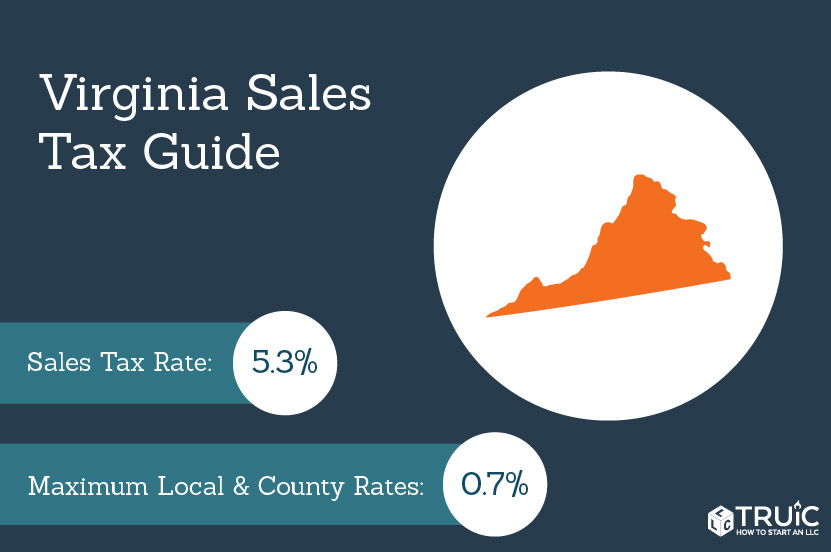

Virginia Sales Tax Small Business Guide Truic

Should You Be Charging Sales Tax On Your Online Store Sales Tax Filing Taxes Sale

Traveling Vineyard Thrive Dashboard Traveling Vineyard Wine Clubs Wine Tasting Tours

States With No Sales Tax On Cars

Wyoming Sales Tax Rates By City County 2022

How High Are Capital Gains Taxes In Your State Tax Foundation

Economic Nexus Laws By State Taxconnex

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors

A Visual History Of Sales Tax Collection At Amazon Com Itep

Www Mmfinancial Org Irs Paymentplan Installmentagreement Lander Wyoming Irs Taxes Tax Debt Debt Help

A Visual History Of Sales Tax Collection At Amazon Com Itep

Woocommerce Sales Tax In The Us How To Automate Calculations

For More Info Visit Https Www Fastincnow Com How To Apply Non Profit Business Sales

Should You Be Charging Sales Tax On Your Online Store Income Tax Best Places To Live Filing Taxes